⛑️ Our Top 10 Digital Nomad Insurance Recommendations

Being a digital nomad is a great way to experience the world while working remotely.

But there are some basics that you need to consider in order to make sure you stay safe, secure and covered whilst working abroad. One of the most important decisions is finding the right insurance for your digital nomad lifestyle.

Best Digital Nomad Insurance Options 2023

1.SafetyWing: Nomad-focused, offers flexibility and affordability.>

2. World Nomads: Known for its broad activity coverage and seen as the go to travel insurance company for adventurous nomads.

3. Heymondo: Features a user-friendly app with real-time assistance & competitive pricing.

4. Insured Nomads: Comprehensive insurance uniquely tailored for the global wanderer.

5. PassportCard: Offers real-time claim processing and direct billing.

6. IMGlobal: Provides a wide range of plans and covers pre-existing conditions.

7. WorldTrips: Provides extensive insurance coverage with the ability to customize your policy.

8. True Traveller: Extensive activity coverage, particularly tailored for UK/EU nomads.

9. Cigna Global: Comprehensive global health options with an extensive network of global medical professionals.

10. Genki: New kid on the travel insurance block offering one of the best options for digital nomads.

What is Digital Nomad Insurance

Digital nomad insurance for digital nomads is a type of travel insurance designed specifically for people who choose to work remotely while travelling.

It typically offers coverage in case of medical emergencies, accidents, luggage loss or theft. It may also include other benefits such as an emergency evacuation & protection against legal problems that may arise whilst in a foreign country.

Digital Nomad Health Insurance vs Travel Insurance?

When researching digital nomad insurance options, one of the first decisions you will need to make is whether you want travel or health insurance coverage (or both).

🏝 Digital Nomad Travel Insurance

- Travel insurance covers a broad number of things like lost luggage, flight cancellations, and a variety of other potential issues that could arise while travelling. Generally, it will also cover your major medical treatment up to a specific maximum.

😷 Digital Nomad Health Insurance

- Health insurance provides you coverage for a vast range of medical situations (not only the major issues), generally with far greater maximum coverage limits, along with concierge-like services to ensure you receive the best available medical care wherever you are.

What to consider when selecting Digital Nomad Insurance?

When it comes to choosing the right digital nomad insurance plan for you, there are a few key factors to keep in mind...

- ☂️ Coverage - Ensure you're fully covered, including any pre-existing medical conditions.

- 💰 Cost - Aim for a balance between coverage and affordability.

- ✍️ Claims process - Before signing up for any plan, make sure to familiarize yourself with how the company handles claims.

- 🌎 Location - Some plans may only be available in certain countries, so make sure to check the availability of your chosen plan.

You might be interested to know:

Our 10 Recommended Digital Nomad Insurance Providers

#1 SafetyWing

Nomad-focused: offers flexibility and affordability.

SafetyWing is a leading global travel health insurance provider, offering flexible worldwide travel and medical insurance for long-term travellers and remote workers.

Its family-centric policies allow for child coverage, and its 24/7 global support ensures that nomads always have a lifeline wherever their journey takes them.

SafetyWing's Insurance Options

SafetyWing offers both Digital Nomad Travel Insurance as well as recently launched dedicated Global Health Insurance. Let's look at each below.

1) Nomad Insurance

The Nomad Insurance plan is designed for digital nomads and long-term travellers. This plan provides medical coverage for travel-related incidents along with certain non-medical benefits.

It has a $250 deductible a maximum claim of up to $ 250.000.

💰 Cost of Insurance

- 18 - 39 years old - $45.08 per month

- 40 - 49 years old - $73.92 per month

- 50 - 59 years old - $115.92 per month

- 60 - 64 years old - $157.36 per month

- 65 - 69 years old - $157.36 per month

2) Nomad Health

Nomad Health has been designed for digital nomads who are looking for comprehensive health insurance that covers their medical needs worldwide and in their home country.

They provide two types of coverage, each covering you up to $1.5 million in medical, with their "Premium" policy adding things like dental, vision and maternity protection.

💰 Cost of Coverage

- 18 - 39 years old - $123 / $238 per month

- 40 - 49 years old - $184 / $391 per month

- 50 - 59 years old - $291 / $606 per month

- 60 - 74 years old - $537 / $1135 per month

#2 World Nomads

Known for its broad activity coverage and seen as the go-to travel insurance company for adventurous nomads.

A favourite among adventurous spirits, World Nomads has made a name for itself with its comprehensive activity coverage.

Whether you're paragliding in the Alps or diving in the Great Barrier Reef, World Nomads has your back. Their strong reputation, further bolstered by positive user reviews, establishes them as a reliable choice for nomads worldwide.

World Nomads Insurance Options

World Nomads offers two digital nomad insurance options, which we'll look at below.

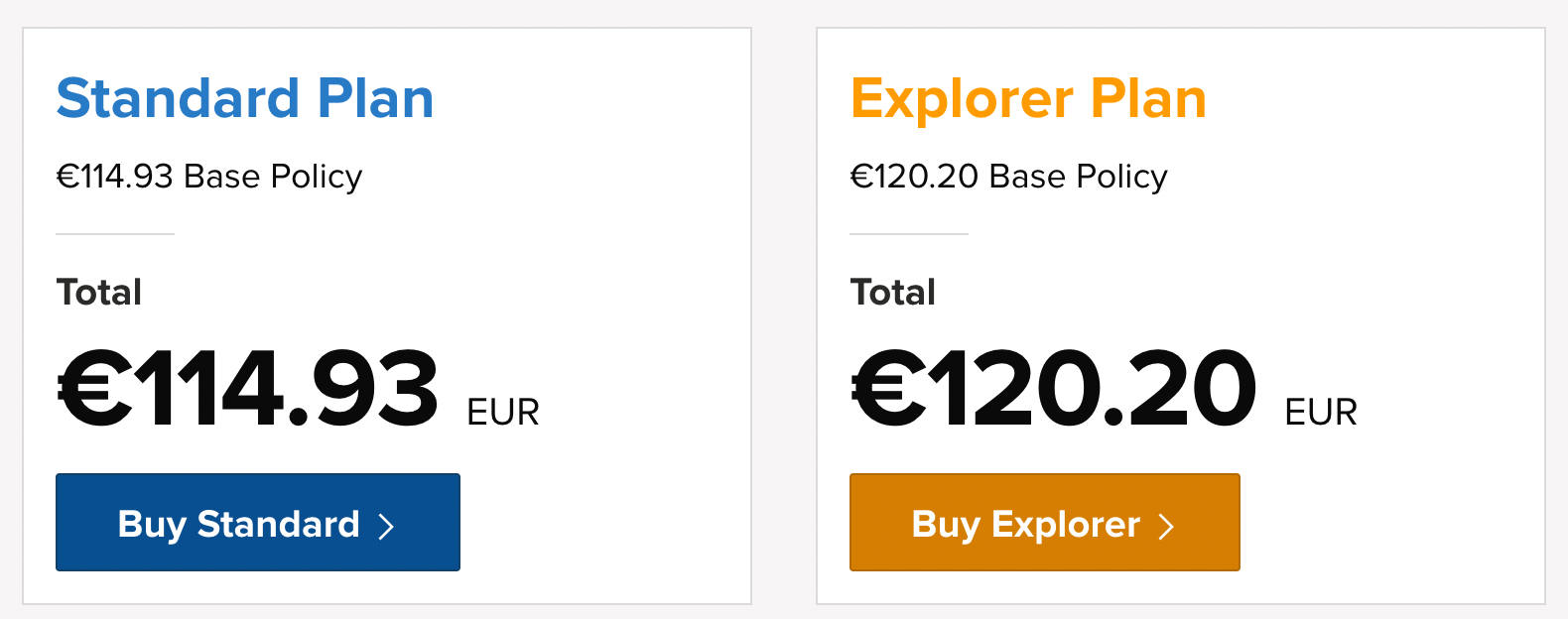

1) Standard Plan

The Standard plan offers a comprehensive insurance package designed to cater to the general needs of travellers, from medical emergencies to baggage loss.

2) Explorer Plan

The Explorer plan is a more premium option offering higher coverage limits and caters specifically to nomads who like to spend their free time after work practising adventure sports.

💰 Expect Costs of Coverage

If you're in your 30s and planning to head to Mexico, expect to pay €114.93 for the Standard plan and €120.20 for their Explorer Plan.

#3 Heymondo

Features a user-friendly app with real-time assistance & competitive pricing.

Embracing the digital age fully, Heymondo offers a user-friendly app that promises real-time assistance, making claims and queries a breeze whilst on the go.

Paired with its competitive pricing, it serves as a go-to option for tech-savvy nomads.

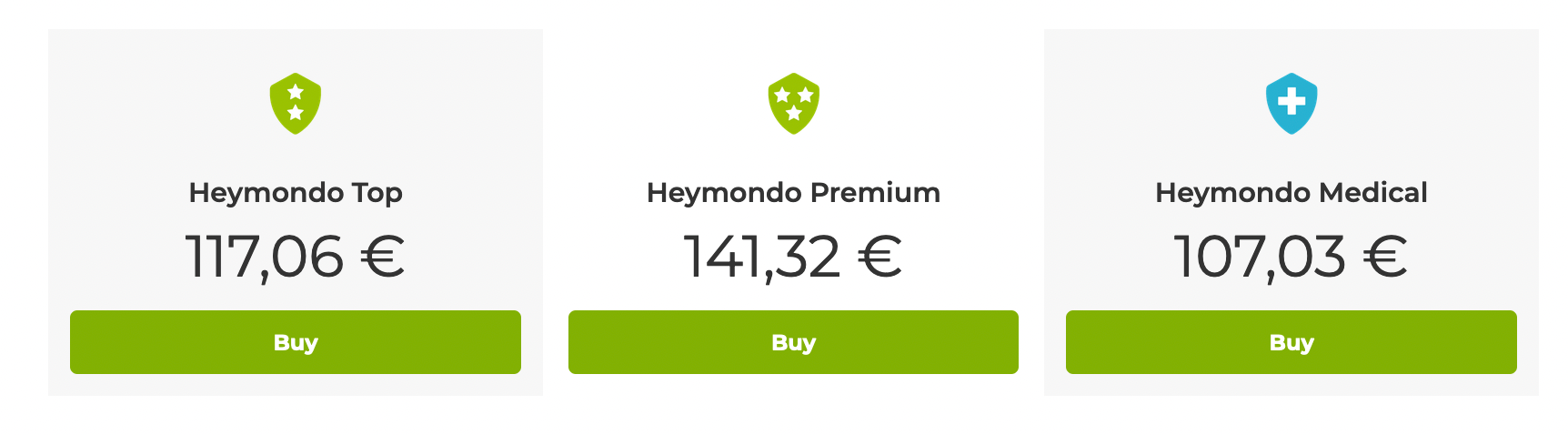

Heymondo Insurance Options

Heymondo offers three types of insurance policies: Single-trip, Annual travel and long-stay travel. We'll look at each below.

1) Single Trip

This is a one-time insurance policy tailored for individuals planning multiple trips within a single journey. It covers various unexpected events that might occur during the trip, including medical emergencies, trip cancellations, or lost baggage.

This is best suited for travellers who don't travel frequently and only need coverage for one particular trip.

💰 Example One Month Worldwide Coverage

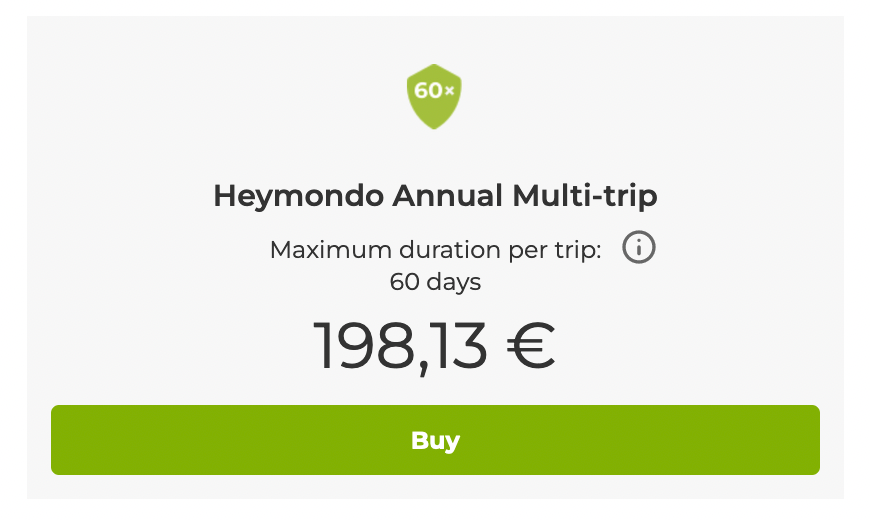

2) Annual Travel Insurance

For avid travelers, the Annual Travel Insurance is an ideal choice. Instead of buying a new policy for each trip, travellers are covered for all trips made within a year.

This policy includes medical coverage, baggage loss, trip delays, and other typical travel inconveniences.

💰 Example of Monthly Cost for One Year Worldwide Coverage

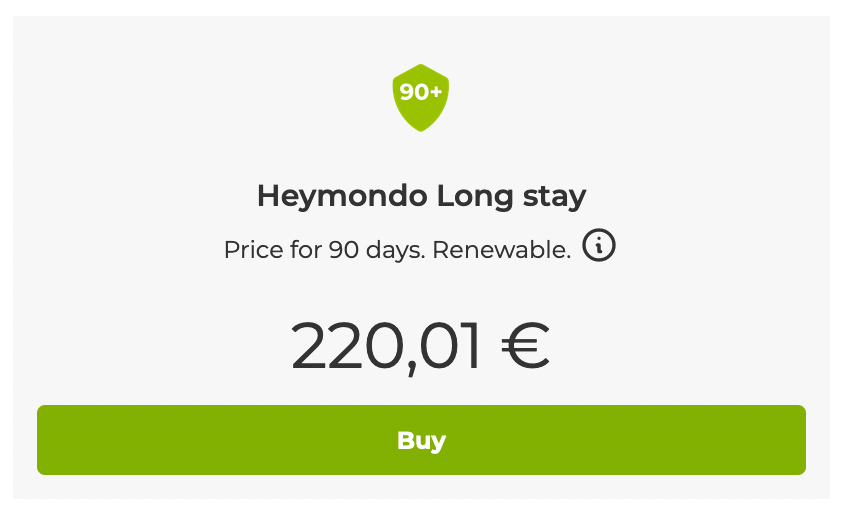

3) Long Stay Travel

Designed for those intending to stay abroad for an extended period, the Long Stay Travel insurance ensures comprehensive protection.

This policy is particularly beneficial for digital nomads who want to ensure they're covered for the many eventualities that might arise during a 12-month stay away from home.

💰 Example of Monthly Cost for One Year Worldwide Coverage

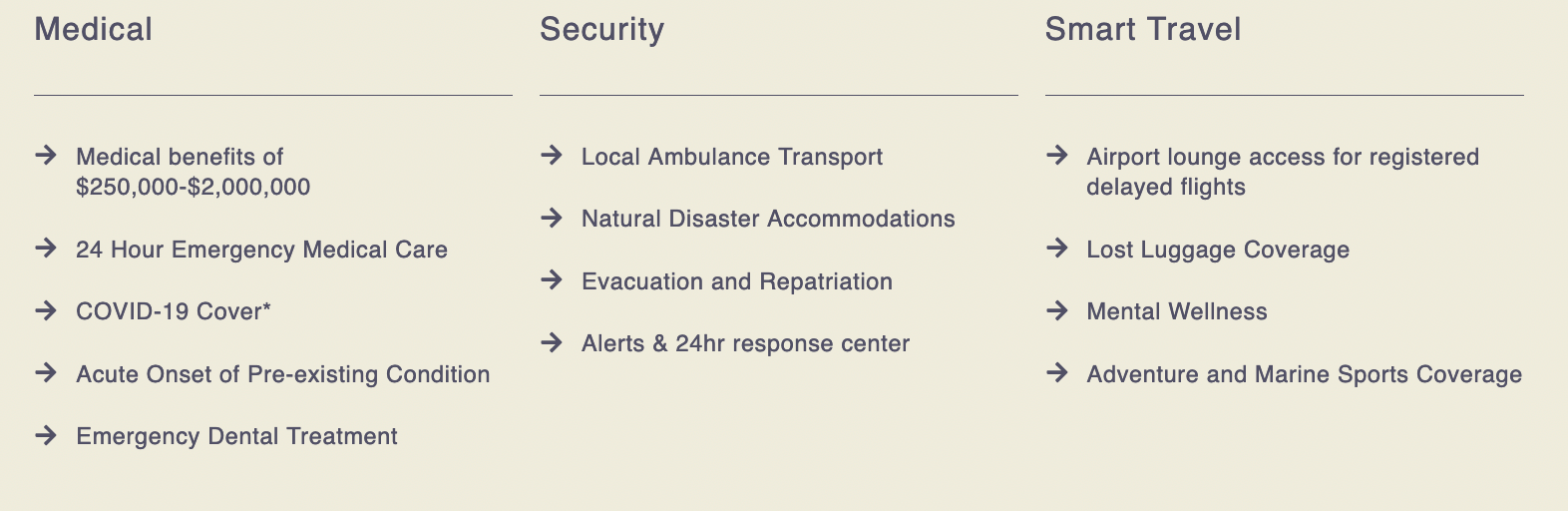

#4 Insured Nomads

Comprehensive insurance uniquely tailored for the global wanderer.

Insured Nomads is a dedicated insurance provider uniquely tailored for the global wanderer. Understanding the distinct lifestyle of digital nomads - one where home could be a Bali beach house one month and a Berlin co-working space the next - Insured Nomads offers comprehensive policies that prioritize flexibility, coverage, and peace of mind.

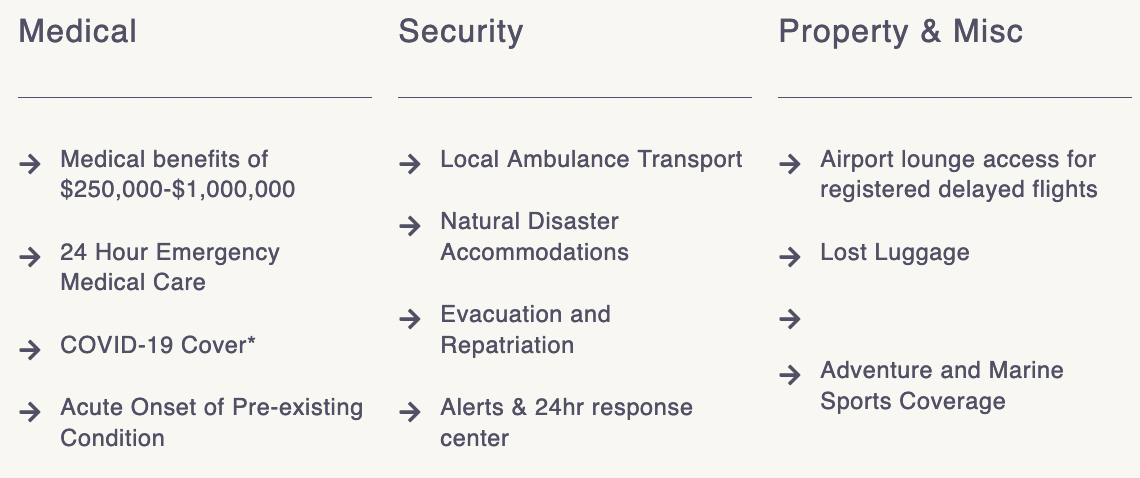

Insured Nomads Options

Insured Nomad offers 3 main insurance policies: World Explorer: Single Trip, World Explorer Multi & World Explorer Guardian. Let's look at each below.

1) World Explorer: Single Trip

Tailored for nomads, this plan offers robust coverage of up to $2 million for those who wish to immerse themselves in new landscapes, cultures, and experiences anywhere from 7 days up to 364 days.

💰 Typical Coverage Cost Per month

- Individual - $92.70/mo

- Couple - $185.40/mo

- Families - $357.60/mo

2) World Explorer Multi

For the digital nomad whose life is a series of thrilling chapters spread across multiple destinations, the World Explorer Multi has got you covered up to $1 million in emergency medical insurance, along with all the other inclusions you'd expect.

💰 Typical Annual Costs of Coverage

- 30 days - $350 (excluding USA) / $475 (including USA)

- 45 days - $437 (excluding USA) / $593 (including USA)

3) World Explorer Guardian

With the World Explorer Guardian plan, you have the flexibility to customize your health and medical travel insurance coverage. You can select from three tiers of total medical benefits: $50,000, $250,000, or $500,000. Additionally, all plans come with trip cancellation and trip interruption coverage.

💰 Typical Coverage Cost Per month

- Individual - $90/mo

- Couple - $203/mo

- Families - $350-$421/mo

#5 PassportCard

Offers real-time claim processing and direct billing.

PassportCard is reshaping the way digital nomads and travellers utilize travel insurance by providing a physical card after signup, which, when needed, can be loaded with the required funds by PassportCard, providing near-instant support.

By doing so, PassportCard aims to help their customers avoid the annoying situation of having to use their own money upfront when an emergency occurs. Pretty neat, huh?

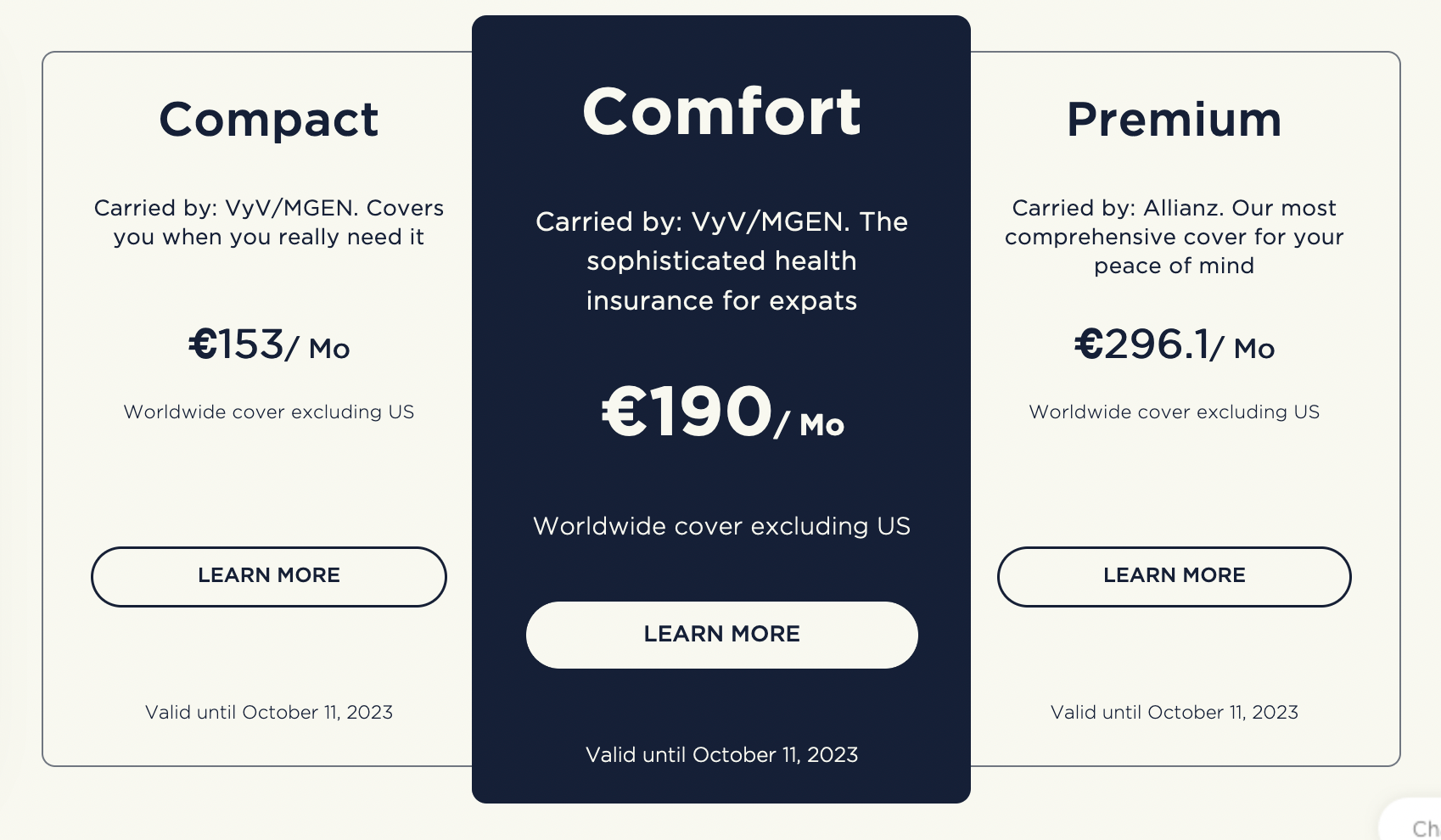

PassportCard Insurance Options

PassportCard currently offers three insurance types; PassportCard PREMIUM, PassportCard COMFORT, and PassportCard COMPACT. We'll highlight each below.

🟡 PassportCard COMPACT

- If you require only the essentials, including hospitalization and inpatient care, with some outpatient services available in a limited capacity, then the Compact Plan is perfect for you. It will cover you up to $1 million per insured year.

🟠 PassportCard COMFORT

- The comfort plan is more comprehensive than Compact, with more inclusions such as maintenance of chronic conditions as well as an increased maximum insured amount of $3.5 million.

🟢 PassportCard PREMIUM

- As the name implies, this is their most Premium coverage, incorporating aspects such as private care vs semi-private care as found in the two previous policies, along with a maximum insurer amount equating to a whopping $5 million per insured year.

💰 Expected Costs

Below you'll find an indication of expected monthly costs, excluding coverage in the USA. When including the USA, we found the monthly price roughly triples. For the most updated prices, make sure to visit the website.

#6 IMG Global

Provides one of the most extensive range of insurance plans in the market and covers pre-existing conditions.

International Medical Group (IMG) is a front-runner in the field of international medical insurance. They have an extensive range of products addressing not only emergencies but also preventive care and even emergency medical evacuation.

With IMG's global support network and 24/7 assistance, digital nomads can focus on their work and adventures, knowing they're backed by an expert in global health coverage.

IMG Insurance Options

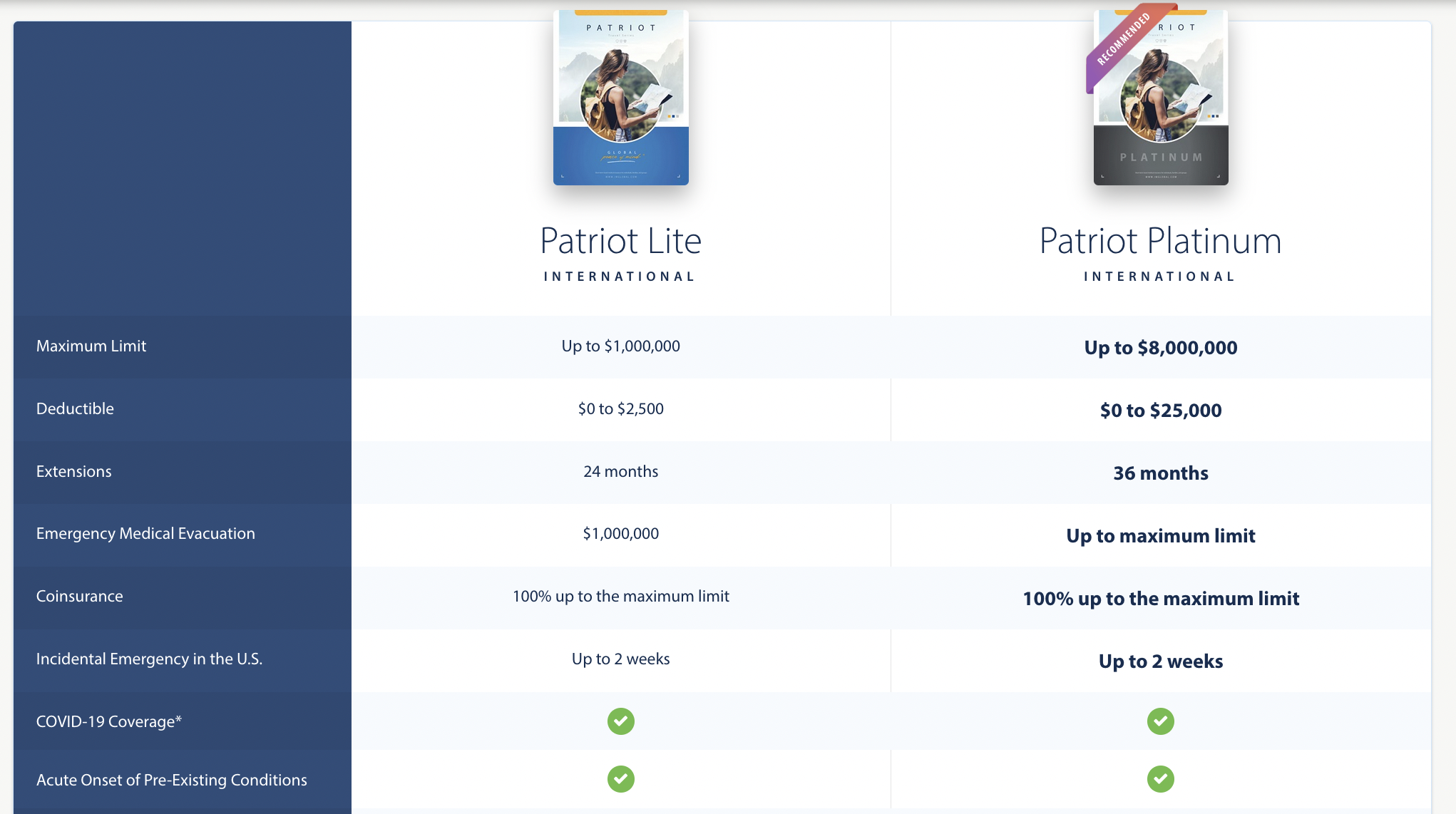

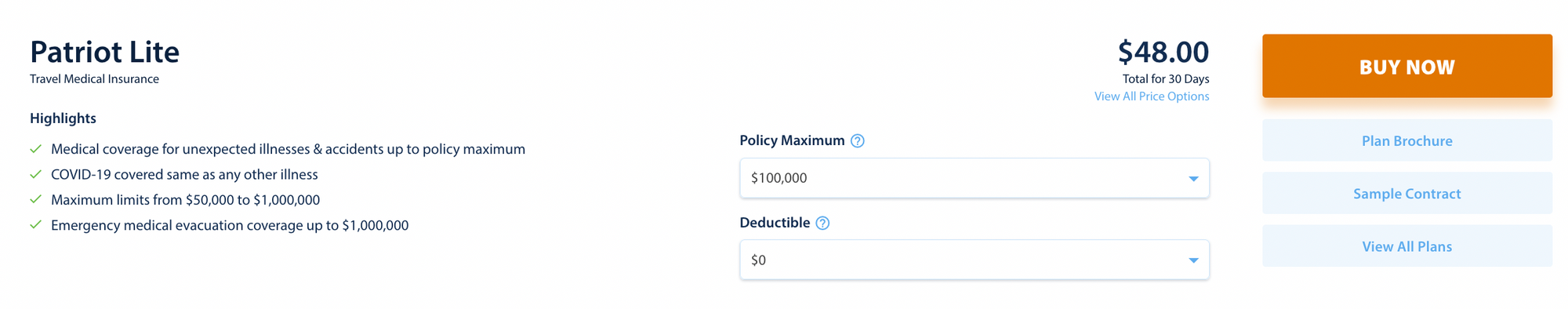

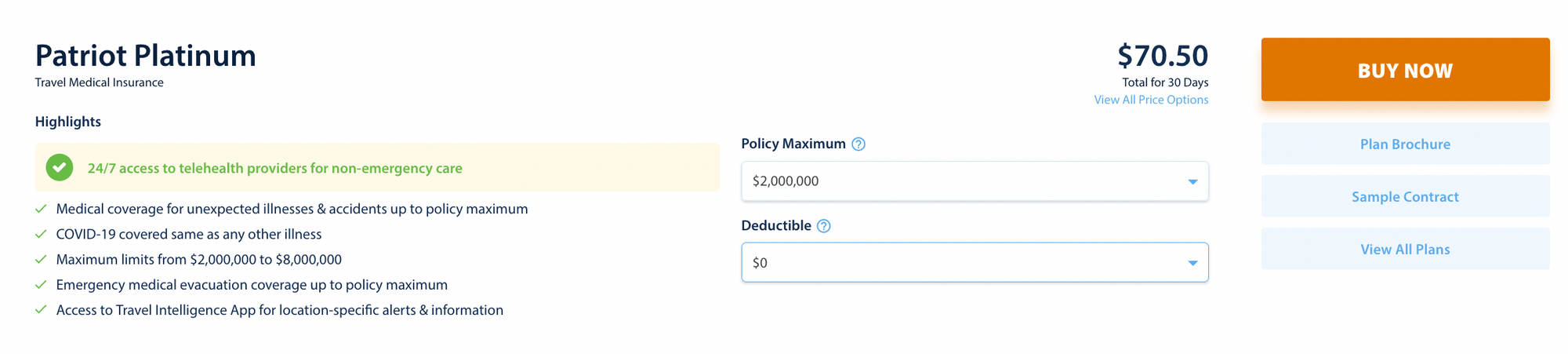

When investigating what insurance options IMG has to offer, we've found their Patriot Series consisting of two insurance plans (Patriot Lite & Patriot Platinum), to be of best fit for digital nomads.

Let's look at both side by side in terms of coverage...

As we can see from the image above, the big difference between the two insurance options is the maximum insurance amount, which then influences the coverage limits for other aspects of the policy.

In the Platinum plan, you can expect to be covered up to a maximum of $8 million vs $1 million in the Lite policy.

Additionally, in the Platinum plan, you have access to Global Concierge and Assistance Services, something not included in Lite. But how does this affect the price?

💰 Expected Cost of Patriot Lite

For someone in their 30s travelling to Mexico, you can expect to pay $48 with a maximum policy amount of $100,000. This will jump to $63 when selecting a maximum coverage of $1 million. Expect this cost to decrease the more deductible you add.

💰 Expected Cost of Patriot Platinum

The Patriot plan jumps up to $70.50 for the same trip for $2 million coverage and reaches $108.38 when selecting the maximum coverage of $8 million.

#7 WorldTrips Atlas

Provides extensive insurance coverage with the ability to customize your policy.

WorldTrips Atlas insurance plans are another solid option for digital nomads looking for coverage while they wander the world whilst working.

In addition to providing a diverse portfolio of options, they offer digital nomads the option to add additional coverage giving greater flexibility and peace of mind.

WorldTrips Atlas Insurance Options

WorldTrips Atlas Insurance options consist of three main types of policies; Atlas Travel, Atlas Premium & Atlas MultiTrip. Let's look at each.

🟠 Atlas Travel

Atlas Travel offers flexible coverage by allowing digital nomads the ability to customize their plan by selecting your deductible, coverage duration, and maximum overall coverage up to $2 million. It's a good option for short-term trips.

🔵 Atlas Premium

Atlas Premium offers everything Atlas Travel does but offers increased coverage limits and is designed for digital nomad Parent's looking for greater coverage for their families. For example, it offers $100K in personal liability compared to $ 25K in Atlas Travel.

🟣 Atlas MultiTrip

Atlas MultiTrip is for nomads who intend to embark on multiple journeys overseas within a span of one year, lasting either 30 or 45 days within a 364-day time frame.

💰 Expected Costs of Coverage

For a trip to Mexico, for someone in their 30's, expect to pay $74 a month for an Atlas Travel plan and $137 a month for Atlas Premium for the maximum coverage of $2 million with a zero deductible.

You can reduce this monthly figure by decreasing the coverage amount and increasing the deductible.

For Atlas MultiTrip, I was quoted $193 for a 30-day plan and $236 for a 45-day plan, both excluding America. This got me a max coverage of $1 million and had a non-optional deductible of $250. Expect the price to jump considerably when including coverage for the USA.

#8 True Traveller

Extensive activity coverage, particularly tailored for UK/EU nomads.

True Traveller is not just another travel insurance provider. It is founded and operated by seasoned travellers who understand the unique needs and challenges faced by digital nomads. Based on their positive customer testimonials found on reviews.io, they seem to be delivering on their promises.

True Traveller Insurance Options

True Traveller split their offerings between two groups of policies; Single Trip and Annual Multi trip policies.

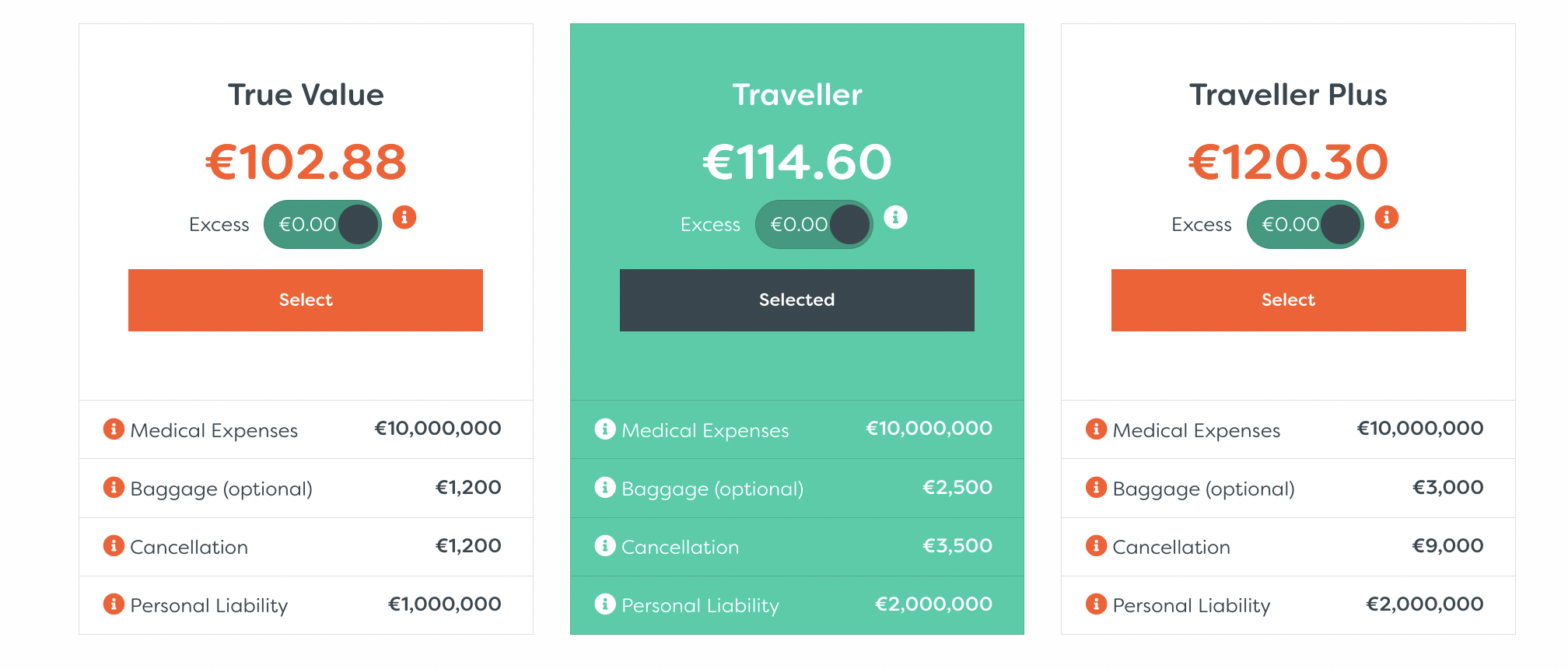

🟢 Single Trip Policies

In their Single trip policy, they offer three plans; True Value, Traveller and Traveller Plus. Below is an example of a 30-day worldwide coverage (excluding America) for someone in their 30s.

All plans offer up to €10 million and increase in price depending on their level of coverage.

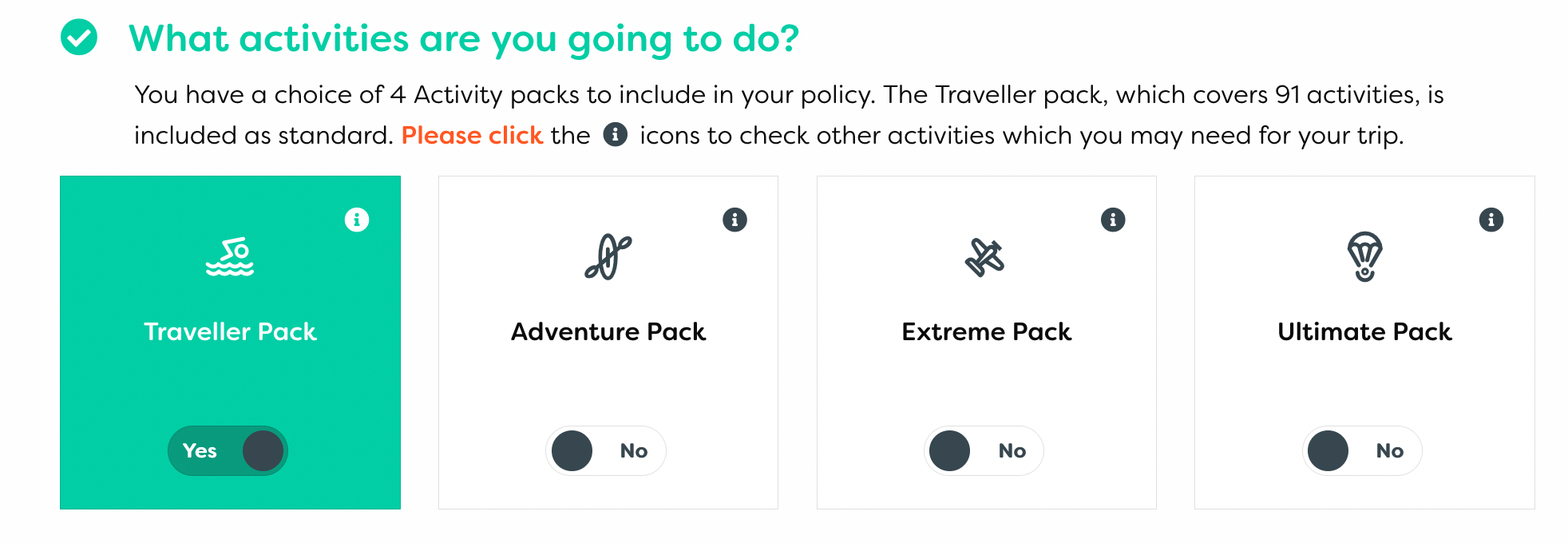

🥾 Activity Packs

When selecting your plan, you'll also have the option of adding different activity packs, covering a vast list of different activities where the expected risk level is calculated into the monthly fee.

The Traveler Pack is preselected. It's worth looking into each to make sure you're types of activities are covered so you avoid any nasty surprises down the road.

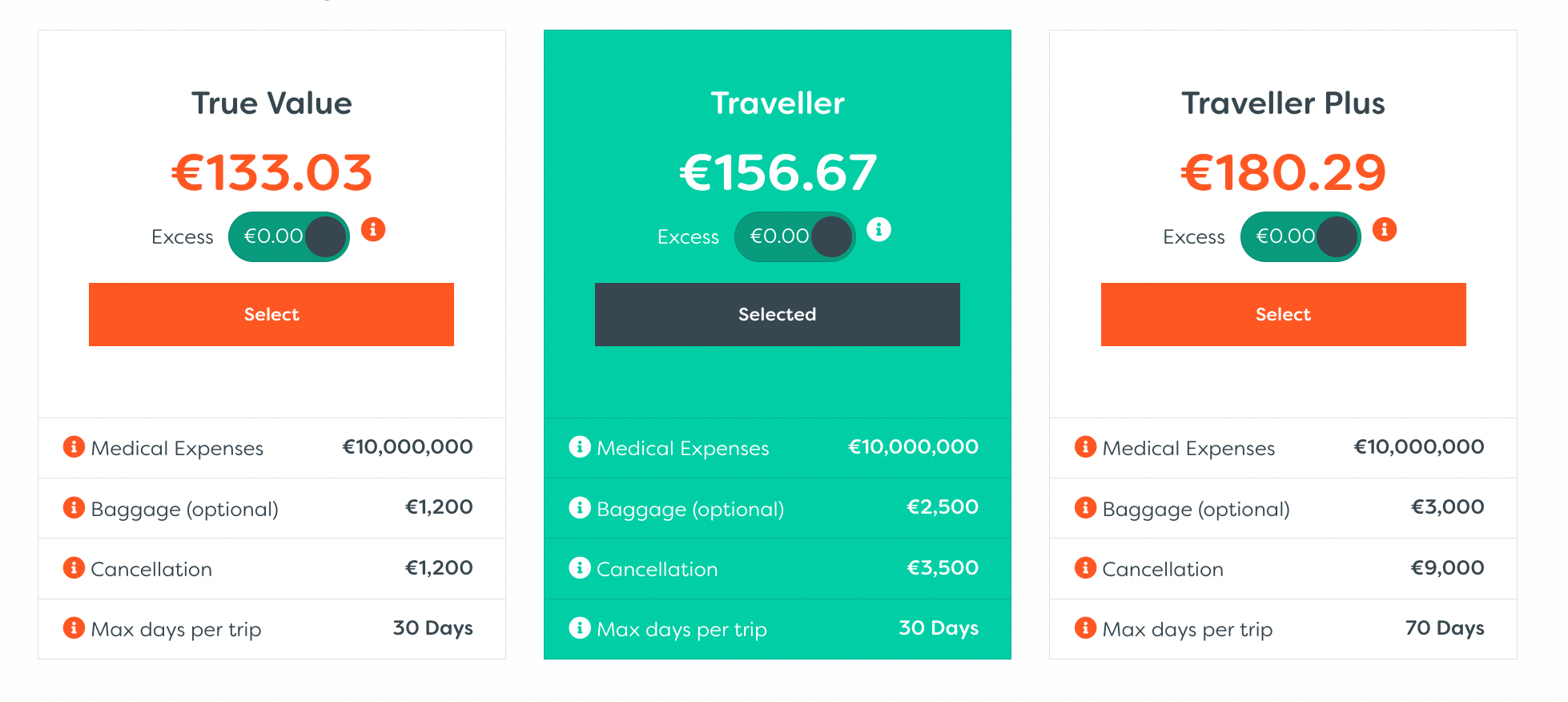

🟣 Annual Multi-trip Policies

In their Annual Multi-trip portfolio, they offer unlimited trips throughout the year for a duration of up to 30 days and 70 days. You can see below that the flexibility provided leads to a slight increase in the monthly price.

#9 Cigna Global

Comprehensive global health options with an extensive network of global medical professionals.

Cigna Global provides comprehensive international health insurance tailored for digital nomads, offering a vast network of medical professionals, flexible plans, and personalized health solutions to ensure optimum health and wellness whilst working remotely from different destinations.

Cigna Global Insurance Options

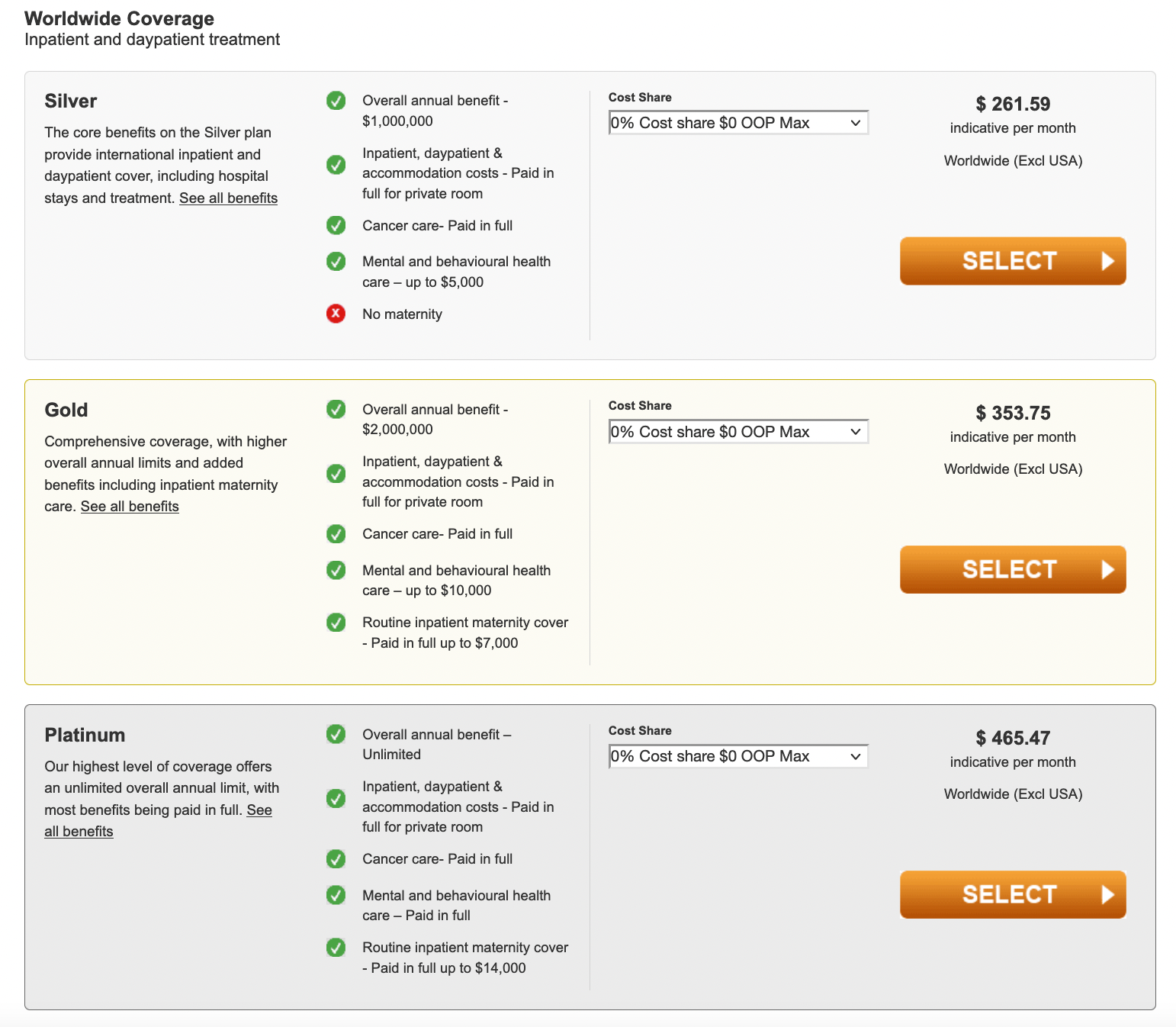

Cigna Global offers two main types of health insurance plans suitable for digital nomads; Cigna Global Health & Cigna Close Care. Let's look at each in more detail below.

🔸 Cigna Global Health

- Experience top-notch global healthcare with two coverage options: Worldwide or Worldwide, excluding the US, with a maximum coverage limit of $1 million

- Customizable with three levels to choose from, four optional add-ons, and flexible payment options, providing you with a range of choices to suit your needs.

- Expect to be covered for day-patient, inpatient and emergency cover, along with cancer care, mental health care & pandemic cover.

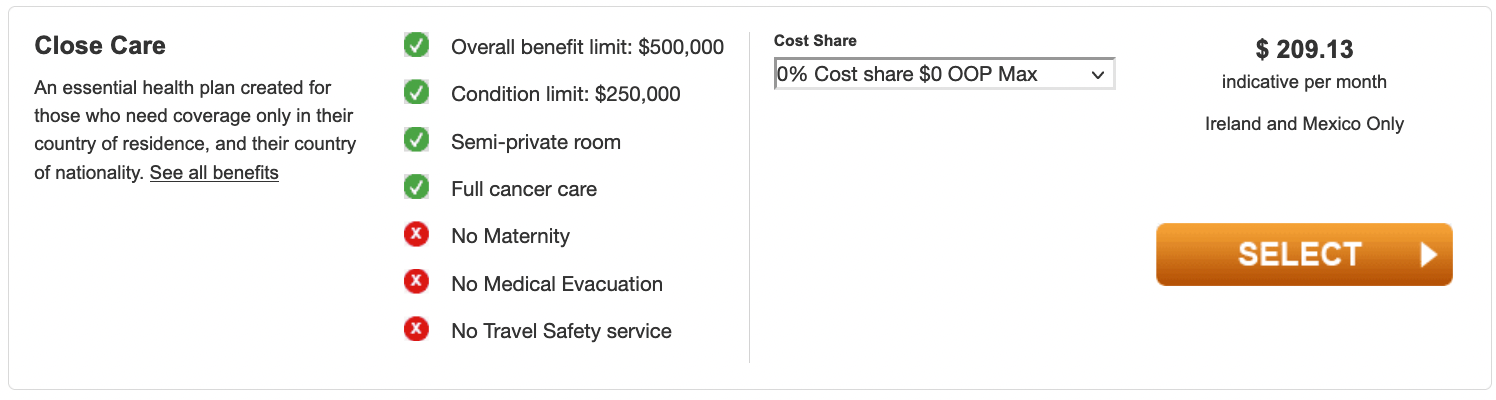

🔹 Cigna Close Care

- Plan provides coverage for both the country you reside in and your home country, allowing you to be protected during return visits up to a maximum coverage of $500k.

- Emergency medical coverage is also provided for temporary trips outside of those two areas.

- Cigna Close Care offers flexibility and affordability, allowing you to customize it according to your specific needs and budgetary requirements.

💰 Expected Costs of Cigna World-Wide Coverage

For Cigna World Wide coverage, for someone in their 30's, you can expect to pay between $261 and $465 per month, depending on which level of protection you select (Silver, Gold or Premium).

This monthly cost is based on a $0 deductible, so expect the monthly fee to reduce the higher the deductible you select.

💰 Expected Costs of Cigna Close Care Coverage

For Cigna Close Care, expect the monthly cost for protection in two destinations (home country and selected destination country) to be roughly $209.13 per month based on a $0 deductible for someone in their 30s.

#10 Genki

New kid on the travel insurance block offering one of the best options for digital nomads.

Genki is one of the new kids on the travel insurance block, founded in 2021, who've built an insurance product that includes all the aspects you want from a package at an incredibly affordable price.

Backed by the Allianze group, they also have some weight to throw around. They offer monthly subscription-based insurances specifically tailored for travellers and digital nomads.

With this focus, we believe they offer one of the best insurance options for nomads currently available.

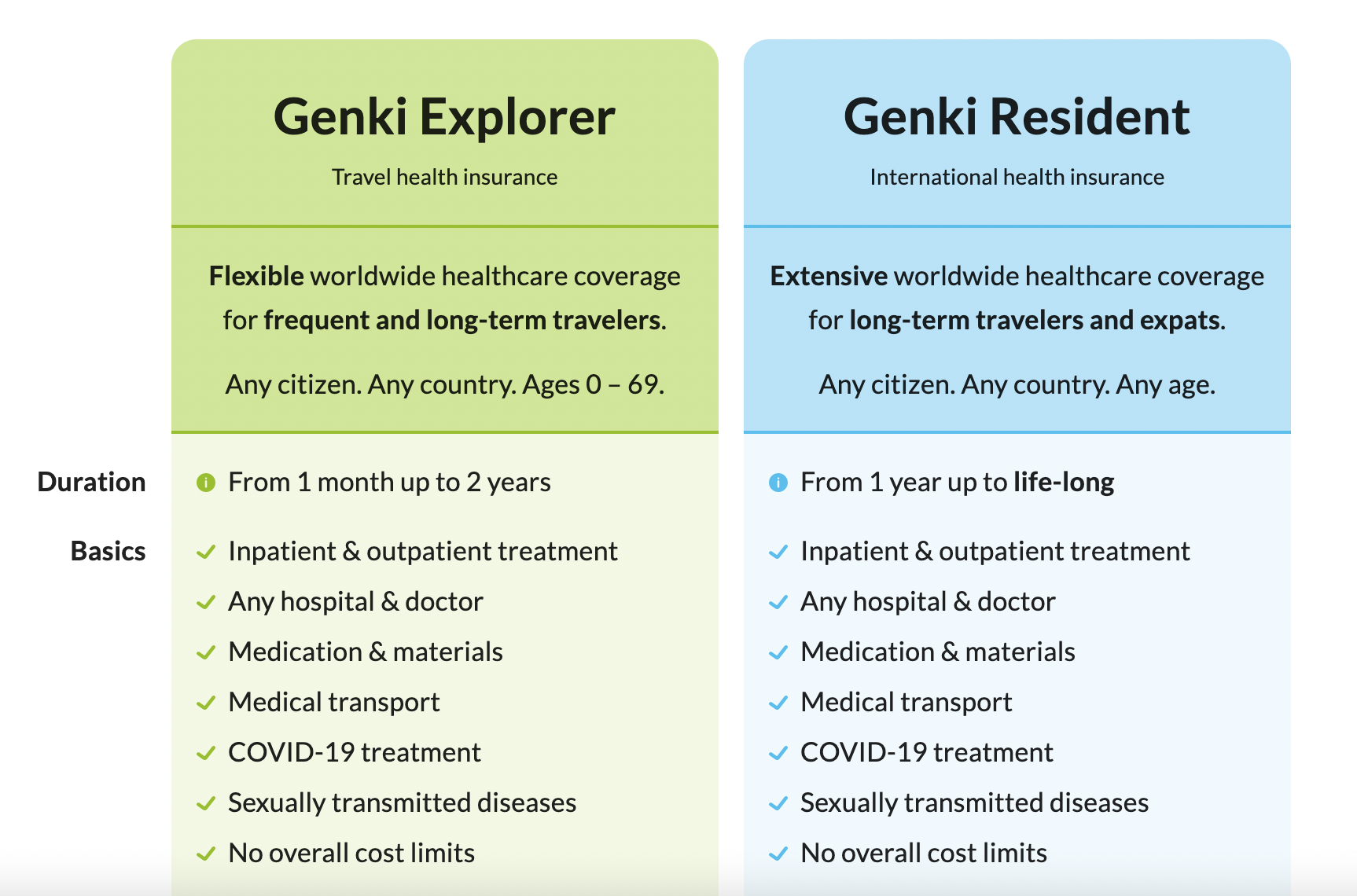

Genki Insurance Options

Genki has two insurance options: Genki Explore (Travel insurance) & Genki Resident (Health Insurance). Let's look at them in more detail below.

🟨 Genki Explorer

- Offering unparalleled flexibility for frequent travellers such as digital nomads and backpackers.

- Choose a monthly insurance subscription that suits your needs, ranging from one month to two years.

- Comprehensive medical coverage is available worldwide.

- All citizens, regardless of residence, are eligible up to the age of 69.

🟩 Genki Resident

- You're all-in-one health and travel insurance offering worldwide coverage

- Available to anyone from any country of any age

- Starting from one year to life-long coverage

- Direct billing with hospitals via their 24/7 hospital assistance.

💰 Expected Costs of Coverage

For Genki Explorer, expect to pay anywhere between $39.90 to $117.70 per month, depending on your age. Genki Resident is more expensive, as is to be expected, considering the additional coverage and benefits.

Their annual plans start at $225 a month for zero deductible and drops to as low as $160 a month if you add a $ 1,000 deductible. All in all, both plans provide cost-effective, benefit-boasting insurance options for digital nomads!

You might be interested

In Conclusion

That's a wrap. In this article, we shared our 10 best insurance options for digital nomads. We hope our list has shown you the multitude of options you have.

From comprehensive global healthcare with customizable levels and add-ons, plans allowing coverage in both residence and home countries, flexible monthly insurance subscriptions, to year-long international coverage - the choice depends on your individual needs and circumstances.

Remember, it's crucial to study each offering thoroughly, considering factors such as coverage limits, add-ons, exclusions, and the provider's reputation, to ensure you make an informed decision.

🤍 Hit us up on Instagram if you have any questions!